There is a defined gulf

Between credit and character

If you doubt this, ask any banker;

He will advise that character is nice

But it is not collateral.”

– Evan Rhys, Poems From The Ledge

The need for finance is universal. Every small business will need funds at some point during its life cycle. The requirements could range from seed funding at inception to eventual needs for working capital financing, funds for new equipment or machinery, to pay or hire employees, to upgrade technology or meet sudden upsurges in demand.

Apart from unconventional sources like angel investors and crowdfunding, small businesses mostly approach banks for SME loans. However, banks rarely lend to small businesses without asking for collateral against the loan. For banks, collateral serves as security in the event of a small business being unable to repay the loan.

For small businesses that have just begun, providing collateral may not always be possible – since their funds are limited and restricted to specific purposes.

The best recourse for a small business is to obtain SME loans without collateral from NBFCs and such other institutions. These institutions have a predetermined set of eligibility criteria, and require minimum documentation from the small business to apply for an SME loan. Their focus is mainly on the soundness of the business’s fundamentals and financial statements. Here’s what a new small business needs to obtain SME loans without collateral.

Steps To Obtain SME Loans Without Collateral

For every institution, the financial health of the business matters since it reflects the business’s ability to repay the loan. For a young business or one that has just begun its operations, it is necessary to prepare a business pitch that highlights business model, the entrepreneur’s background, estimated sales and the estimated growth rate and returns. Additionally, the business must fulfill the eligibility criteria set by the institution, and provide certain documentation for the institution’s reference. Let’s take a look at some of them:

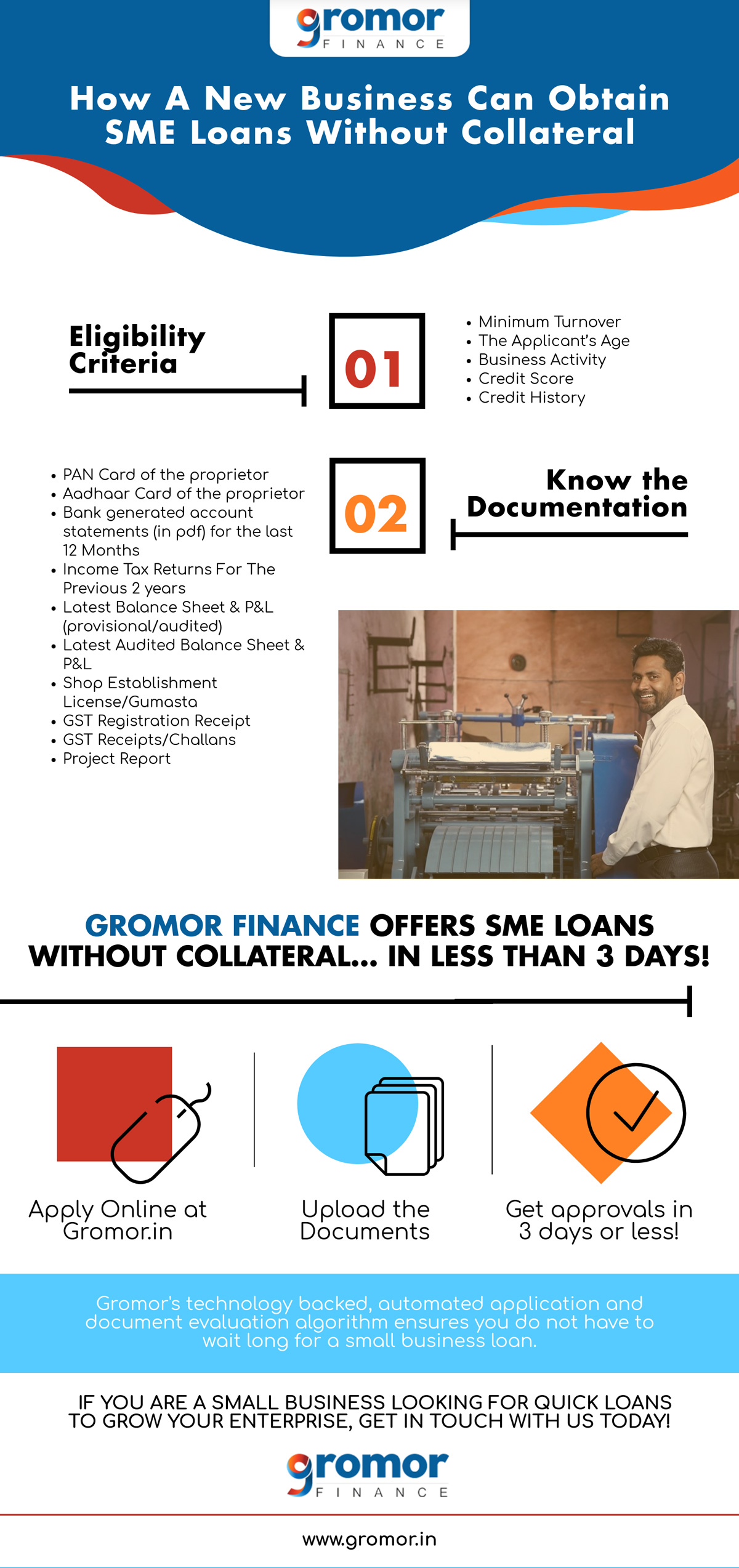

1. Eligibility Criteria

Different institutions have different criteria for evaluating a small business’s eligibility for SME loans without collateral. Some of them are mentioned below:

- Minimum Turnover

- The Applicant’s Age

- Business Activity

- Credit Score

It is important to note that most institutions will prefer small businesses that have been in business at least for a year, to provide SME loans without collateral. Additionally, a new business will have to pay attention to its credit history – insufficient credit history doesn’t give a clear picture of the business’s creditworthiness, or its ability to repay loans. For detailed information about the eligibility criteria, refer to the article here.

2. Documentation

The documents needed along with the application for SME loans without collateral are primarily those the establish the identity of the business, and its financial well-being. The institution should be able to evaluate the ability of the business to repay the loan since there’s already the risk of not having a collateral. Some of the documents needed are listed below:

- PAN Card of the proprietor

- Aadhaar Card of the proprietor

- Bank generated account statements (in pdf) for the last 12 Months

- Income Tax Returns For The Previous 2 years

- Latest Balance Sheet & P&L (provisional/audited)

- Latest Audited Balance Sheet & P&L

- Shop Establishment License/Gumasta

- GST Registration Receipt

- GST Receipts/Challans

Additionally, the business may also need to submit a project report highlighting the reasons for availing the SME loans without collateral. The project could include detailed information about factors such as :

- Land and building required

- Manufacturing process and capacity

- Requirement of machinery and raw materials

- Power and water required

- Manpower needs

- Marketing costs

- Financial analysis and viability of the project

Again, one must note that, for a business to qualify for SME loans without collateral, it should have at least a year’s activity to its credit.

If a business is eligible, and has all the necessary documentation in place, obtaining SME loans without collateral is quite easy. In fact, Gromor Finance disburses the loan amount in less than 3 days!

Gromor Finance Offers SME Loans Without Collateral… In Less Than 3 Days!

Gromor Finance offers a simple online process to apply for SME loans without collateral. All a business has to do is:

1. Apply Online

Log on to the site ‘gromor.in’ and apply for a loan.

2. Submit All Documents

Upload scanned copies of all the necessary documentation – Gromor’s strict adherence to policies ensures that all confidential information is kept safe!

3. Get Necessary Approvals

Gromor Finance provides instant approval if the documents and the eligibility criteria are as required – the process is backed by relevant technology!

4. Avail Loan Disbursal

Once the loan has been approved, the amount is disbursed and available for immediate use.

That’s It!

If you are an established small business looking for SME loans without collateral, get in touch with Gromor Finance today!