As a small business looking to meet its immediate funding requirements, opting for quick business loans is the ideal solution. Business loans not only help to meet working capital requirements, but can also support plans to acquire new machinery/equipment, upgrade technology, hire new employees, deal with the seasonal nature of a business, or meet sudden upsurges in demand.

Typical Avenues For Availing Small Business Loans:

Primarily there are 2 options explored by most, not including friends and family.

Banks:

Any small business trying to get a business loan will first approach banks. While banks do offer business loans, they usually demand collateral as security, against the loan. Also, the process of acquiring the loan from a bank can be lengthy, since banks have stringent policies and demand a lot of documentation.

NBFCs (Non-Banking Financial Companies):

NBFCs are an attractive alternative to banks. These institutions offer quick business loans without security, with minimum documentation. They also have a simpler set of criteria for small businesses, and focus more on the soundness of the business, rather than the size.

In order to avail quick business loans, from NBFCs in India, a small business needs to focus on two fundamental requirements – eligibility and documentation.

Avoiding Rejections When Applying For Quick Business Loans In India

The trick to availing Quick Business Loans for your Small Business in India is to be very clear with the documentation and the eligibility criteria.

This will not just help you get a loan for your small business quickly, but also avoid rejections in the process.

A rejected loan negatively impacts your CIBIL score – which is often one of the criteria for approval of loans.

Also, The process of applying for a business loan itself affects a business’s credit score. A business must opt for a business loan only after thorough consideration.

While most of the NBFCs look for CIBIL score as one of the eligibility criteria, a few of them have an in-house credit evaluation methodologies which help them understand a small business’s repayment capacity.

Eligibility Criteria and Documentation For Quick Business Loans In India:

The common eligibility criteria for small business loans are Minimum Turnover, Applicant’s Age, Business Activity Duration, and Credit Score, along with the documentation to establish these such as PAN and Aadhaar of Proprietor, Last 12 month Bank Statements, ITR returns, required licenses and compliances, etc. among others.

In fact for a more detailed understanding of the eligibility criteria and documentation, refer to this handy checklist before applying for a business loan!

If you have checked off all the requirements mentioned above, getting quick business loans is a simple process! In fact, with Gromor Finance, it could be as quick as 3 days… or less!

Get Quick Business Loans From Gromor Finance!

All you have to do is follow the simple, transparent process below:

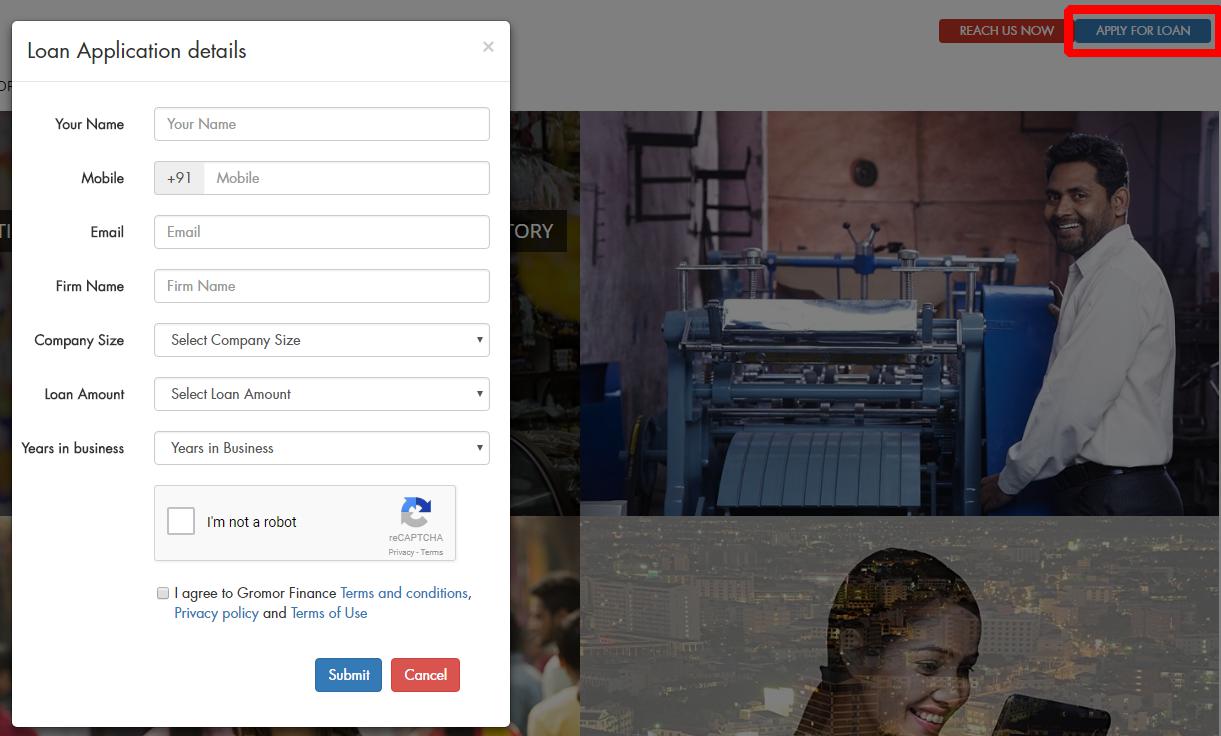

1. Apply For A Loan

Visit Gromor.in and fill in the online application form – from anywhere!

2. Submit Relevant Documents

Upload the documents mentioned above. Be assured that all your confidential information is safe with Gromor!

3. Get Loan Approvals

Thanks to Gromor’s automated evaluation, getting approvals has never been faster!

4. Avail Loan Disbursal

Upon approval, the loan amount is disbursed and available for immediate use!

That’s how simple it is!

So, if you are a small business looking for quick business loans, what are you waiting for?

Get in touch with Gromor today!