Funding isn’t just needed for a one-time investment in a business. There might be a number of reasons where an owner might require additional funds during the course of his/her small business. It could be needed to meet working capital requirements, to meet an unseasonal upsurge in demand, or simply to upgrade technology and manpower.

One of the best ways to obtain such intermittent funding is to apply for a business loan. A small business owner could either avail one from banks (usually secured) or opt for unsecured business loans from NBFCs and such other institutions. An important point to consider while opting for a business loan would be the business loan interest rate. Given that the business loan has to be repaid, the business loan interest rate would matter to determine how much the small business owner needs to keep aside to meet the interest payments.

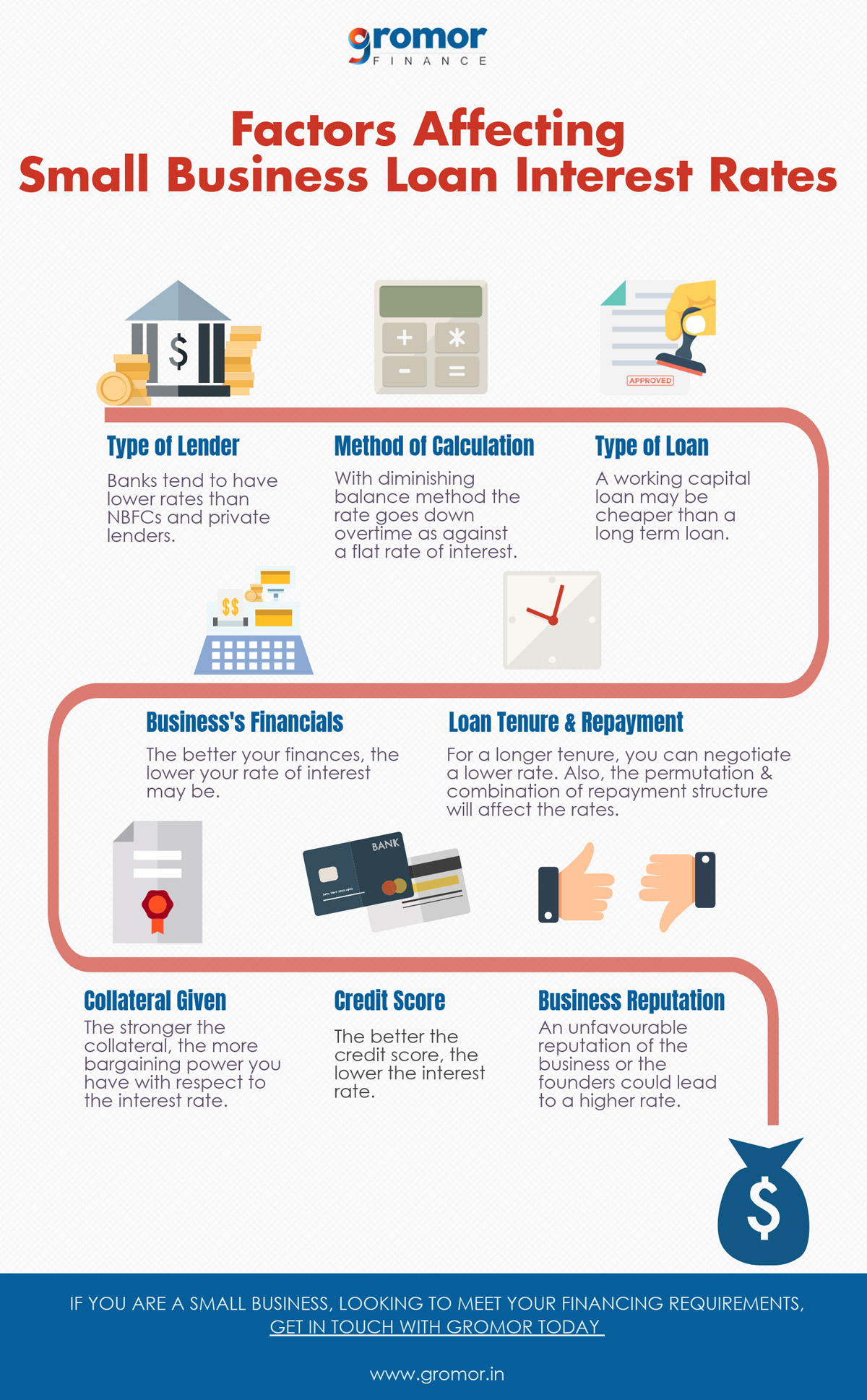

Business loan interest rates differ based on the type of the institution lending the loan, the tenure of the business loan, and other factors. A small business owner will need to consider these before opting for a business loan.

Factors Affecting Business Loan Interest Rate

Here are some of the factors affecting the business loan interest rate, a small business owner needs to consider before applying for a business loan.

1. Nature of The Lender

There are many types of lenders such as banks, non-banking financial institutions (NBFCs) and informal lenders. Since the risk is progressively higher for the lender, the interest rate also increases accordingly. You can opt for a more formal way of borrowing money and reduce your interest expense by doing some paperwork.

The interest rates charged by banks and NBFCs range between 13% and 21% (1) depending on the tenure and the loan amount, in addition to the type of loan and the financials of the small business.

2. Loan Amount

The interest is charged on the principal. Naturally, a higher amount attracts a higher interest expense. A business cannot modify the loan amount to a great extent once the purpose is decided. However, the interest rate can be charged differently.

The interest can also vary depending on the method for calculating interest.

Where the diminishing balance method is followed, interest is charged on the remaining or outstanding portion of the principal. If interest is a flat rate throughout the term of the loan, regardless of principal repayments, it can prove to be more expensive. You can negotiate with the former in order to reduce your interest expense.

3. Type Of Loan

The nature of the facility also impacts the interest rate, which varies depending on the purpose of the loan (for example, working capital loan or loan for an asset).

Interestingly, it is not always that a working capital loan is cheaper than a long-term loan. This is one of the few factors where the variance is quite significant depending on other aspects of the loan and the lender. Comparing and contrasting different lenders and their offers can help you select the one which helps you minimise your interest expense.

4. Business Financials

An important factor that determines your bargaining power on the interest rate of your business loan is the financial status of your business. The first thing is to have an organised structure or system in place for handling the finances. As a result, the quarterly and annual financial statements (profit and loss statement, balance sheet and cash flow/funds flow statement) should be available and easily accessible.

Keeping a tab on these factors and ensuring that they seem palatable to a potential lender can increase the chances of a lower interest rate.

The common parameters considered for financial success are:

- Sales – both quantum as well as growth.

- Earnings – the amount of operating, pre-tax and after-tax profits.

- Asset base – the size of the balance sheet and the split between short-term and long-term assets.

Apart from these, certain financial tools or ratios are also used to estimate the ability of the business to repay the loan. These vary depending on the other factors. Some of the common ones are:

- Debt service coverage ratio

- Interest coverage ratio

- Current ratio and quick ratio for studying the liquidity

5. Duration/Tenure Of The Loan

The interest rate and expense is also a function of the tenure of the loan. If the period is longer, it is possible to negotiate for a slightly lower interest rate.

6. Structure Of Repayment

Today, there are different repayment structures for loans. There can be no principal repayment for a certain period after the disbursal during which only the interest is paid. Once the principal repayment begins, the interest can be calculated based on the diminishing balance method (on the principal amount outstanding). In this structure, the interest expense might be on the higher side, but it also gives you more flexibility of funds.

A structure that is in contrast to the previous one is repayment of principal as early as possible. There are various permutations and combinations of interest and principal payments, which can change the interest expense as well as the time of payment.

7. Collateral

Collateral is an asset or a guarantee given as a security for a loan. This will be seized in case of failure to repay the loan.

The stronger the collateral, the more bargaining power you have with respect to the interest rate.

Collateral such as property is considered to be the safest. Financial assets such as shares and other investments can also be provided as collateral. Certain institutions like NBFCs offer collateral-free loans, also called unsecured business loans, and may charge a higher interest rate.

8. Credit score

An individual’s credit score is a reflection of the credibility of the person in terms of repaying a loan on time.

The better (or higher) the credit score, the lower the interest rate.

While extending loans to a small business, the promoter’s credit score is almost always an important factor to consider. This is primarily dependent on the past payment records. Your credit card payments, previous loans taken and even payment record to creditors are factors that are considered while calculating your credit score. Some of the other factors are age, income and existing financial obligations.

9. Business Details

Apart from the financial situation, a lender always considers certain non-financial factors to assess the soundness of the business.

Since these factors are considered to be high-risk if they are unfavourable, a much higher business loan interest rate can be charged.

A few of these factors are:

- Promoter’s reputation/qualifications

- Number of years of operation

- Professional expertise

- Compliance with regulations

Additional expenses

Over and above the business loan interest rate, the small business might also need to pay the following charges:

- Processing Fee

- Stamp duty and other statutory charges

- Commitment fees

- Foreclosure charges

A business loan is a good way to ease the financial tension or to fund a particular asset. Sometimes, it can be a necessity more than a luxury. Whatever be the case, the borrower always looks to reduce the interest expense and finance charges pertaining to borrowings.

In this endeavour, individually analysing the factors that impact the interest rate and deciding how best to optimise each one can aid in securing the best possible interest rate for the facility required.

Are you looking for unsecured business loans? Contact Gromor right away!