There are no two ways about it – A business loan is meant to be repaid… Like, why are we even mentioning it!

A small business may apply for a business loan for a multitude of reasons – to meet working capital requirements, to buy new equipment/machinery, to hire new employees, to upgrade technology or simply to meet sudden upsurges in demand. While banks rarely offer small business loans without a collateral, NBFCs and such other institutions do offer loans without security (also referred to as unsecured business loans). They offer a simple online process, with simple eligibility criteria and minimum documentation.

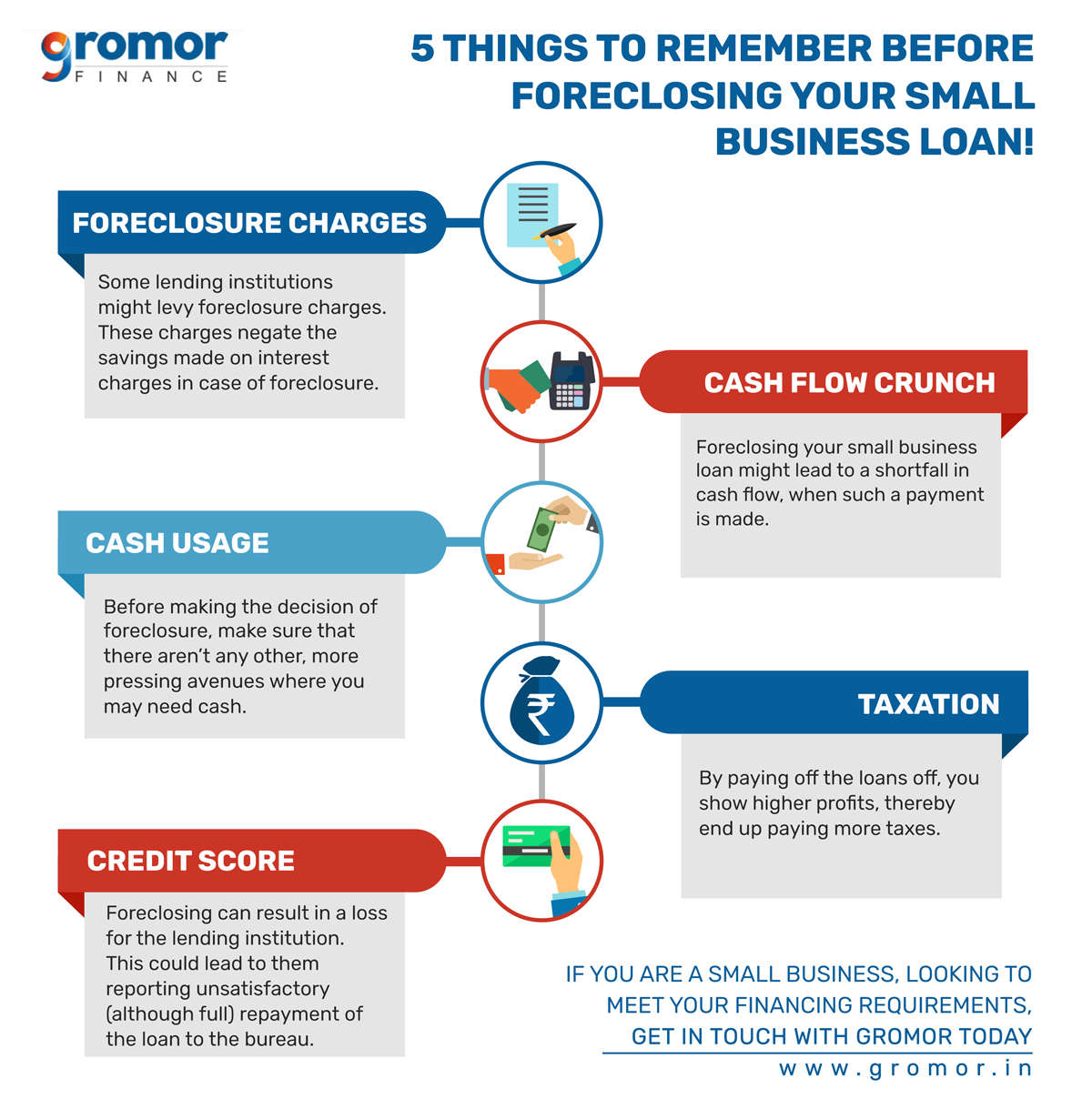

These business loans have varying tenures. Many small businesses might opt to repay the loans before the determined tenure, whenever they have surplus cash flow. This is called ‘foreclosure’.

This can be done either by making part payment before the payment of the is due or making the entire payment for the outstanding amount before the loan tenure. However, before opting for foreclosure, it is important for the small business to consider certain points mentioned below.

Foreclosing Your Small Business Loan? Know This First…

1. Foreclosure Charges:

Foreclosing your small business loan leads to a loss of interest for the lending institution, which is its income from the said loan. To discourage small businesses from foreclosing the loan, the lending institution might levy foreclosure charges and a prepayment penalty. These charges negate the savings made on interest charges in case of foreclosure.

If you intend to foreclose the small business loan, make sure that you read the terms and conditions of quick business loans availed by you very closely. It also makes sense to negotiate with the lending institution to do away with foreclosure charges before you take the loan.

2. Cash Flow Crunch:

Foreclosing your small business loan might lead to a shortfall in cash flow, during the month when such a payment is made. Make sure that you weigh the consequences of pre-closing the loan, and that you don’t end up taking another loan to cover the cost of repaying the earlier one. Make sure that foreclosing does not land you in a situation where you are short of funds.

3. Cash Usage:

It is not necessary that you must prepay a small business loan if you can.

Before making the decision of foreclosure, make sure that there aren’t any other, more pressing avenues where you may need cash. It could either be for buying new equipment or machinery, for inventory, or simply as a cushion for other payments or seasonal losses.

4. Taxation:

The interest you pay on your small business loans can be claimed as a deduction while filing your tax returns. However, by paying the loans off early, you show higher profits, thereby paying more taxes.

For a small business, this can be a major cause for consideration.

5. Credit Score:

A good credit score is a major criterion to be eligible for a small business loan. Usually, it is considered ideal to borrow from lending institutions that report to credit bureaus. They report your repayment history to the credit bureau, therefore establishing your credit history and score, that can be referred to in the future. If you have been zealously making the payments, you can be assured of ease in obtaining small business loans in the future.

However, foreclosing a small business loan can result in a loss for the lending institution – as mentioned earlier under ‘Foreclosure Charges’. This could lead to the lender reporting unsatisfactory (although full) repayment of the loan to the bureau – thereby negatively affecting your credit score. One way to avoid this is to discuss this beforehand with the lending institution – or partner with institutions who won’t be dishonest with you!

While foreclosing your small business loan might seem like a good idea to reduce the burden of debt, it is important to consider the above factors to make sure you don’t leap from the frying pan into the fire!

If you are looking for small business loans, get in touch with Gromor Finance today!