Did you know that it is possible to improve the operational efficiency of your business by making a few changes in the way you allocate your short-term resources?

Working capital management is an underrated but excellent way of propelling your small business forward. By knowing what goes into it and how to make this work to your advantage, you can improve the timeliness and efficiency of your business, thus making it success ready.

You can boost the business performance and be free from the worry of running out of cash by learning to manage your working capital effectively.

To better manage working capital, one first needs to understand what it is comprised of and then familiarise oneself with the yardsticks to assess its strength. After this, one can easily understand how to make the best of each component.

Components of Working Capital

Working capital is made up of a few financial line items. A rudimentary knowledge of what each one involves is necessary to understand which ones are applicable to your business and how you can make the most of every aspect. It is not necessary that your balance sheet should have every component or sub-component; it varies depending on the scale and industry. These components are listed below.

Major components:

- Cash and cash equivalents

- Receivables or debtors

- Inventory (raw materials, work in progress and finished goods)

- Payables or creditors

Other components:

- Prepaid portion of overhead expenses (indirect costs for which advances are given)

- Outstanding expenses (indirect costs that are yet to be met)

- Short-term investments

- Portion of a long-term loan payable within a year

In order to evaluate if the state of the working capital is favourable or otherwise, It is necessary to use quantitative metrics, namely the Net Working Capital (NWC) and Operating Cycle. NWC refers to the difference between current assets and current liabilities while operating cycle refers to the number of days or months required for a business to complete one full cycle of operations right from procurement to receipts from debtors. The Operation Cycle is also called the ‘Cash Conversion Cycle’.

In order to make sure that your working capital position is ideal, here are some of the things you need to consider.

5 Things To Keep In Mind To Manage Working Capital Better!

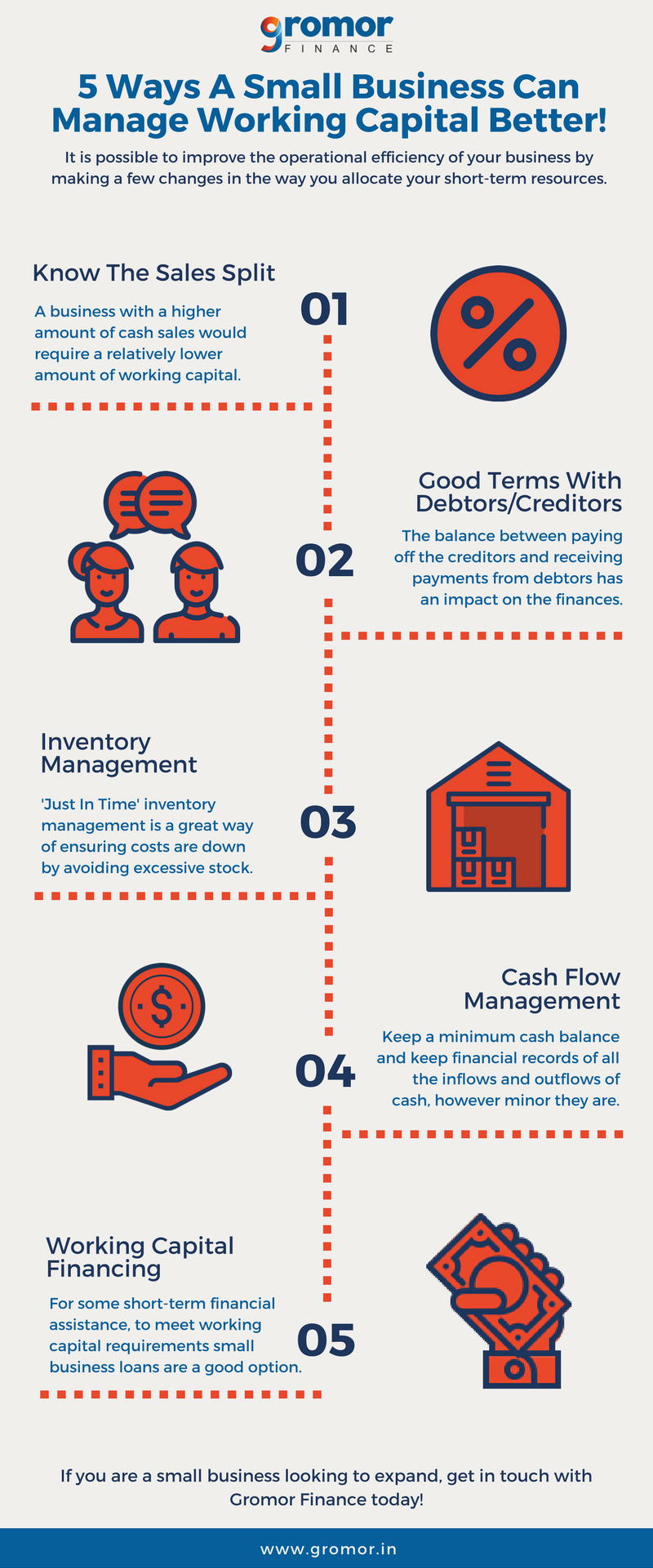

Let’s look at some ways a small business owner can manage working capital better.

1. Keeping An Eye On The Sales Split

Sales have a direct impact on the working capital and it is therefore absolutely imperative that one prepares and relies on the revenue forecast in order to manage working capital better.

The split between cash sales and credit sales is the key element here. A business with a higher amount of cash sales would require a relatively lower amount of working capital.

For a business in which the major chunk of the sales are credit sales, the average period for which credit is extended needs to be considered. Naturally, a longer period would attract a higher need for working capital. A credit extension policy must be in place so that the enterprise has a guide to refer to when it comes to negotiating and dealing with individual clients. Having different payment options and structures can speed up the receipts, reducing the need for working capital.

The seasonality of business also plays an important role here. A business for which sales is high for a few months in a year will require more working capital at that time alone. This is when it should consider taking a working capital loan. On the other hand, a business that is operating at more or less the same level throughout the financial year can opt for a revolving line of credit.

Boosting sales is another way of keeping your business flush with cash.

2. Favourable Terms With Debtors/Creditors

It is important for a small business to manage its relationship with its debtors and creditors, to ensure a favourable working capital position. The balance between paying off the creditors and receiving payments from debtors has a major impact on the cash flow of the business. The terms and conditions of purchase and payments (frequency, quantum, and mode) should be communicated clearly to debtors and creditors.

A good rapport with the creditors by making all payments on time improves the credibility of the business. It also enables the small business owner to negotiate better terms with them, and probably also gain discounts on purchases. Similarly, offering discounts on cash payments to debtors motivates them to try and make the payments earlier than usual. Additionally, levying interest on late payments is also an effective way to get debtors to pay up early.

3. Inventory Management

JIT (Just In Time) inventory management is a great way to ensure that a small business cuts down on costs of storing excessive stock, also referred to as safety stock. It enables a business to remain ‘lean’ by operating with low inventory levels. This doesn’t just increase efficiency but also decreases waste. In order to follow this method of managing inventory, a small business needs to understand its inventory requirements beforehand by forecasting demand and work keeping this benchmark in mind to minimise the cash blocked up in inventory, and manage working capital better.

4. Cash Flow Management

Cash flow and working capital are inextricably tied to each other when it comes to a small business. It is best to keep a minimum cash balance, below which it would be necessary to arrange for funds. This way the small business owner won’t have to face the situation of actually running out of funds. Another way to manage cash flows efficiently is to keep financial records of all the inflows and outflows of cash, however minor they may be in order to have an accurate set of financial statements that can help the small business plan and manage working capital better. Here are some other ways to manage cash flow better.

5. Working Capital Financing

If the need arises for some short-term financial assistance, a small business needn’t shy away from looking at ways to meet working capital requirements. One way is to obtain small business loans from banks or NBFCs. While banks usually demand collateral, NBFCs and such other institutions offer loans without security. A small business needs to be eligible to apply for a loan, and present the necessary documentation to be able to avail it.

Unless one understands what exactly working capital means and how to measure it, there will not be any standardised and sustainable way of managing working capital better.

A small business can greatly benefit by following good practices of cash, inventory and payments management. If the situation requires for external assistance by way of a working capital loan, the business can reach out to financial institutions.

Do you think you require transient financial assistance to improve your business? Get in touch with Gromor to see your potential for growth with us!