Working capital management is an important part of managing both the operational and the financial aspects of a small business. A shortfall in working capital can throw a small business off-kilter. It is safe to say that a favourable working capital position is crucial for a small business to function efficiently and effectively. There are certain factors that determine the working capital requirements of a small business. Let’s look at them individually and understand the significance of their impact on working capital.

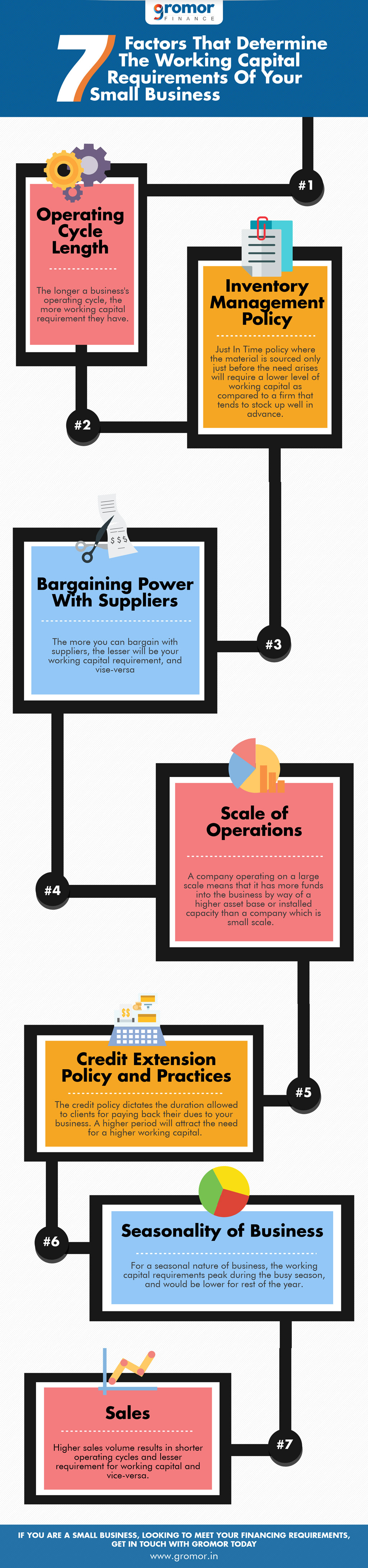

7 Factors That Determine The Working Capital Required For Your Small Business

Various aspects of a business can impact the working capital and consequently, the short-term financial assistance required by a business. There are 7 critical ones that must not be overlooked when it comes to evaluating the working capital requirements for your small business. Here they are.

1. Length of The Operating Cycle

The length of the operating cycle refers to the number of days taken, right from procuring material to making collections against sales from customers. This can be measured in days or months.

The length of the operating cycle is directly proportional to your working capital requirements. So, a longer period will attract a higher amount.

Generally, production intensive enterprises such as those in automobile manufacturing will have a longer operating cycle and firms that have a less intensive production process such as a bakery, will have a shorter operating cycle. As an effect of this, the former will require a lot more working capital than the latter. An entrepreneur has to make suitable financial arrangements, depending on the time taken for production.

2. Inventory Management Policy

There are several ways of managing inventory. The best one is the one that suits the needs of your business, keeping in mind the time it takes to deliver a commodity to your clients. However, the policy that is adopted and practised can impact the working capital.

A just-in-time or JIT policy where the material is sourced only just before the need arises will require a lower level of working capital compared to a firm that tends to stock up well in advance. A JIT policy is also beneficial for those businesses which handle perishable products.

Unless it is absolutely required either for cost-saving, tax-saving or for other purposes, over-stocking is not recommended since this would block a chunk of the working capital.

3. Bargaining Power With Suppliers

The predecessors in the supply chain are the ones from whom we procure material from or outsource services to. These inputs can then be further processed and refined and can be sold to the clients of the business. We usually negotiate with these predecessors or suppliers for a better price and for the terms and conditions offered.

This factor is inversely proportional to the working capital requirements.

This is because the more bargaining power that you have over your suppliers, the better your prospects are for lowering the cost or for extending the credit period. This, in turn, will positively benefit the working capital situation of your business since it now has lesser outflows (thereby increasing the Net Working Capital) and an increase in the time that you have to repay your suppliers (leading to a smaller and faster operating cycle).

4. Scale of Operations

This refers to the size of the firm. A company operating on a large scale means that it has more funds into the business by way of a higher asset base or installed capacity than a company which is small scale.

A larger firm would definitely require a higher amount of working capital compared to a smaller one.

This is because the monetary needs for procuring material and meeting day-to-day expenses for the former will be higher. A smaller firm will have simpler and a relatively smaller need for funds for operations. This advantage is offset by the fact that large-scale entities can enjoy economies of scale while small-scale entities cannot.

The scale of operations of a firm is not always objective. Compared to other firms in the same geography or industry, a firm can become smaller and smaller as the horizons widen. However, the government has distinct definitions of what construes a ‘micro’, ‘small’ and ‘medium’ enterprise in terms of the value of long-term assets on the books of the firm.

5. Credit Extension Policy and Practices

A small business will have to make sales on a deferred payment basis in order to ensure that it secures the business and generates revenue. The credit policy dictates the duration allowed to clients for paying back their dues to your business.

A higher period will attract the need for a higher working capital.

There are good chances of the owner of a small business being lenient about collecting money from clients who owe him or her. So, even if the agreed date of repayment is crossed, an entrepreneur might hesitate to request for payments since this might hamper the relationship and possibility for future sales. Such practices, though seemingly good for the business, can hurt the working capital situation of the firm. Therefore, an entrepreneur needs to firmly insist on timely payments.

6. Seasonality of Business

Some industries are naturally more seasonal than the others. This means that the sales and operational activities are not spread out evenly throughout the financial year. One or more periods ranging from a few weeks to a few months see an increase in the principal revenue-generating activities.

An example of this can be the tourism industry. A hotelier can experience higher demand in December and May. This will require a higher amount of working capital since there will be more expenses to meet. In contrast to this, a pharmacy might not require additional working capital at specific points during the year since the revenue streams will be more or less the same.

7. Sales

Among the various factors, the size of sales is one of the important factors in determining the amount of working capital. In order to increase sales volume, the enterprise needs to maintain its current assets. In the course of time, the enterprise becomes in the position to keep a steady ratio of its current assets to annual sales. As a result, the turnover ratio, i.e., current assets to turnover increases reducing the length of operating cycle. Thus, lesser the operating cycle period, lesser will be requirements for working capital and vice versa.

Are you looking for a small business loan to meet your working capital requirements? Get in touch with Gromor today!