Every business needs capital, at different stages of its existence. From the seed capital required to establish the business to funds needed to purchase new equipment or invest in a new space, to develop new products, hire employees, upgrade information technology, etc – the need for capital is endless. Thus, it becomes all the more necessary to understand the concept of ‘cost of capital’.

A business raises funds from various sources, mainly categorized under two heads, namely equity and debt. In case of equity, investors will provide capital in exchange for a percentage of the profits – i.e. a stake in the business. In the case of debt, a business will take business loans from banks, NBFCs and such other institutions – the repayment being in the form of interest, and eventually, the principal amount.

All sources of funds, such as the ones mentioned above, have associated costs. These funds, are then utilized for investments in various assets.

The ‘cost of capital’ can thus be analyzed from two separate points of view:

- The acquisition of funds

- The application

In case of an acquisition, the cost of capital would refer to the rate at which the funds are borrowed. In terms of application, the cost would refer to the return on investments.

The viability of an investment would depend on the return being equal to or greater than the cost of acquiring the funds invested.

Let’s try to understand how the cost of capital affects small businesses.

Demystifying Cost of Capital For Small Businesses:

For small businesses, cash flow is king. It represents the part of overall business earnings that can be used by owners without impairing the ongoing operations. One of the important factors that affect cash flow, is working capital. Working capital serves as a cushion to meet requirements like bridging the gap between supplier and customer payments, paying salaries, dealing with the gloom phase in seasonal businesses, meeting an emergency order, etc.

Unlike larger organizations that hire dedicated teams for working capital management, for smaller businesses, the onus might fall on the owner or the core team. Keeping a check on day-to-day needs might be cumbersome, leading to situations where there might be a disconnect between demand and supply.

To meet the shortfall, the business will start looking for sources for immediate funding – normally, in the form of business loans from NBFCs and such other institutions. The cost of capital, in this case, would refer to the interest rate charged on the loans. The business will have to evaluate if the return on investment of the loan amount is high enough to cover the interest to be paid.

The cost of capital is affected by both, intrinsic and extrinsic factors. Let’s take a look at them.

Factors Affecting Cost Of Capital

1. Demand and Supply of Capital:

Demand and supply of capital affect the cost of capital. If the demand for funds in the economy increases, lenders will increase the required rate of return, and vice-versa. Supply of funds has an inverse relationship to the cost of capital: If the supply of fund increases then the cost of capital decreases; and if the supply of funds decreases, the cost of capital increases.

2. Market Conditions:

The existing market conditions of the industry where the funds are to be invested play an important role in determining the cost of capital. Risky projects lead to an increase in the cost of capital, as lenders demand a higher rate to compensate their risk. On the other hand, if the market conditions are such that investments will have a high and secured return, then the risk will be lower and obviously, the cost of capital will be less.

3. Unsystematic Risk:

Unsystematic risk, the industry-specific hazard inherent in each investment, is of two types: business risk and financial risk. Business risk arises due to the investment decisions of the company. Financial risk arises due to financing decisions, e.g. the proportion of debt and equity in the capital structure. Business risk and financing risk affect the overall cost of capital of a firm. A firm’s total unsystematic risk is the sum of business and financing risks. The cost of capital is directly proportional to the total unsystematic risk of the firm.

4. Volume of Financing:

A high volume of capital also increases the overall cost of capital due to issue related costs and the greater risks involved. The liquidity risk associated with a high volume of capital also increases the cost of capital. If the firm uses a lower volume of capital, the lenders of the funds are assured that their funds will be returned, thereby reducing the cost of capital.

5. Income Tax Rate:

Tax considerations have a major impact on the capital structure of a business, therefore affecting the cost of capital. The tax deductibility of interest payments makes debt financing (through business loans) valuable; that is, the cost of capital decreases as the proportion of debt in the capital structure increases.

Here’s a quick visual summary of the factors affecting the cost of capital:

Calculating Cost of Capital: Weighted Average Cost Of Capital (WACC)

Having considered what cost of capital means to a small business, and the factors that influence it, let’s understand how it is actually calculated.

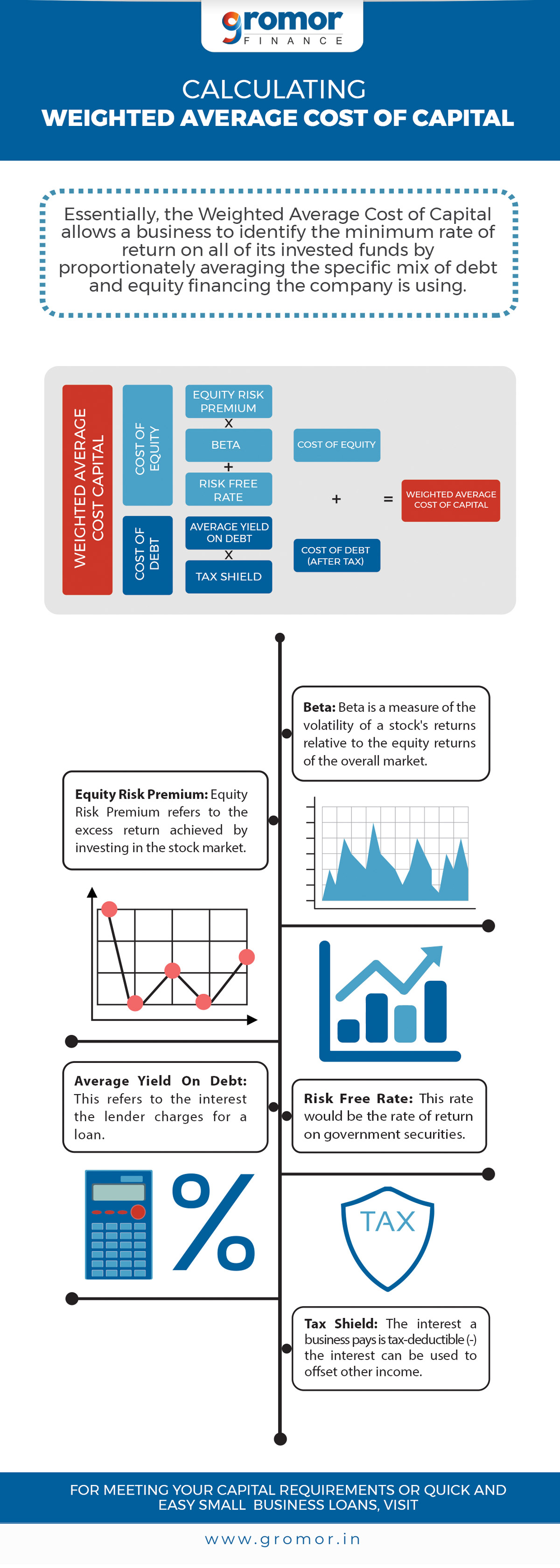

Each capital component takes up a certain portion (percentage) of the business’s capital structure. Essentially, the WACC (Weighted Average Cost of Capital) allows a business to identify the minimum rate of return on all of its invested funds by proportionately averaging the specific mix of debt and equity financing the company is using.

The WACC is also used a discount rate (interest rate used to calculate the net present value of future cash flows) to calculate the value of a business.

Equity Risk Premium:

Equity Risk Premium refers to the excess return achieved by investing in the stock market, in comparison to risk-free returns (returns on government securities).

Beta:

Beta is a measure of the volatility of a stock’s returns relative to the equity returns of the overall market. It helps weight the cost of equity by accounting for risk.

Risk-Free Rate:

This rate would be the rate of return on government securities.

Average Yield On Debt:

This refers to the interest the lender charges for a loan.

Tax Shield:

The interest a business pays is tax-deductible – the interest can be used to offset other income, thereby reducing the taxes a business has to pay.

Refer to the visual summary below for a quick recap:

Being informed about the cost of capital helps a small business, not just to optimise its capital structure, but also to make the best use of business loans.

If you are a small business looking for a business loan, get in touch with Gromor today!