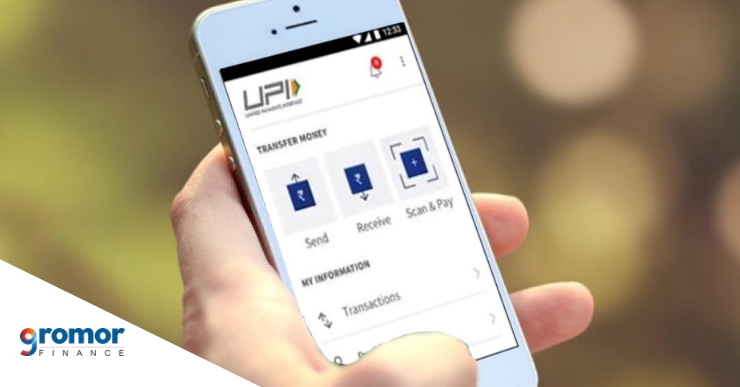

UPI is an instant real-time payment system and has features like customer-friendliness, security, ensuring safe transactions, etc.

UPI allows the instant transfer of money from a bank account to another bank account.

A KYC is not required for UPI payments.

UPI is increasingly used by customers as the payment gateway to repay loans in recent times. Many companies are therefore introducing UPI into online payments for loan repayment.

This can also help reduce the repayment rates.

What led to the increase in usage of UPI for payments?

Customers find it to be a very smooth and time-saving process.

UPI can be used to repay all kinds of loans from housing to business. This has led to an increase in UPI payments for loans.

How small businesses can use UPI for loan payment?

Banks, other online lenders, and those who offer online payment gateways offer UPI to customers for online transactions.

This is also a safer and easy way for small businesses to make payments instantly.

If you want to repay your loan using UPI, you can scan the QR code through any UPI enabled application to pay the outstanding amount.

Here is how you can make payment using UPI:

- Log in to your account and enter the Loan account number

- Generate a QR code

- Then, log in through the UPI app

- Scan Code

- Proceed with the Payment

- You will receive a confirmation message stating that your transaction has been successful

If you want to take an unsecured loan for your business, get in touch with Gromor Finance now!