“Learn from the mistakes of others. You can’t live long enough to make them all yourself”. – Eleanor Roosevelt

This lesson has been a part of our lives since childhood. We watch people around us making mistakes, professionally and personally, and vow never to repeat them in our own lives. A small business owner can apply the same principle to his or her business, as well. Observing the competitors, understanding the rationale behind their decisions, and trying to avoid the mistakes they make can go a long way in building a sustainable business with a better ability to deal with setbacks and problems.

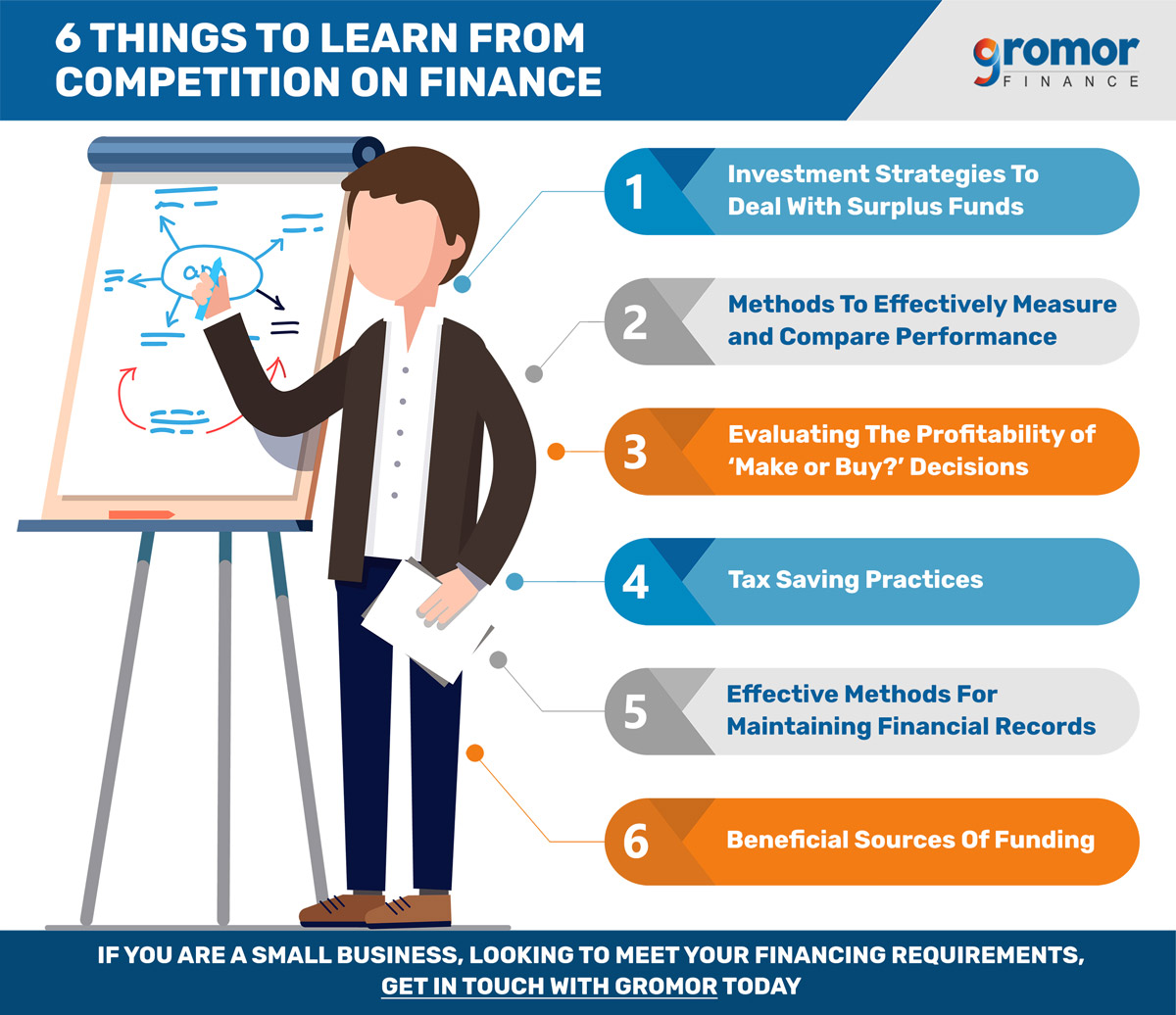

Financial Lessons You Can Learn From Your Competitors!

Finance is the lifeblood of a business. An entrepreneur needs to take extra care and be cautious about the financial decisions that he or she takes since the slightest slip can adversely impact the business. In order to be wary of such potential situations, a business person must consider what the competition is doing. One can also pick up on ideas for growth by observing them, especially their branding and marketing strategies.

Here’s an insight into certain aspects of finance which can be achieved by minutely analysing the competition’s actions.

1. Investment strategy

How firm deals with surplus funds or which avenues of investment it chooses can impact its financial health in the long term. If a neighbouring business has tasted success by ardently following a particular strategy, it may be a good idea to understand why and how it worked, and replicate the same.

One must keep in mind that exact replication may not work since there are factors specific to each business. Tweaks must be made in order to account for idiosyncrasies.

An investment strategy can be studied in order to minimise the risks as well. If a competitor has lost funds in certain financial products, it is prudent to analyse why they weren’t successful and apply that knowledge rather than blindly ruling out investment in the same or similar products.

2. Managing cash flow

Cash flow management lies at the crux of small business operations. The cash flow status of a business determines how healthy it is, and also plays an important role when applying for small business loans. A business can try to understand the methods used by competitors for cash flow management and apply them.

3. Measuring performance

A business can use different metrics or combinations of metrics to measure different aspects of it from profitability to employee turnover. However in order to compare two or more enterprises in the same industry, one needs to consider the business performance. Adopting the techniques used by competitors can help the business see where it stands in relation to its competitors and can also set a reasonable benchmark or target.

There are many financial tools to measure performance. These are percentages, ratios, absolute numbers and trends. A few common metrics are:

- Percentage increase in top line (either year-on-year or compound annual growth rate)

- Profit margins – operating, pre-tax and after tax

- Returns on capital employed or equity

- Asset turnover

4. Make or buy decisions

A make or buy decision involves choosing between manufacturing or doing a process in-house and buying the product or outsourcing the service to an external party. Such decisions have a significant impact on the operating cost. A ‘make’ decision might require financing to install infrastructure or hiring costs for finding the right resource to complete the service. A ‘buy’ decision might involve periodic payments enforceable by a contract. Since both these options will have a financial impact, it is wise to take a look at what the competitors are doing in to get an idea of what the industry offers and what is likely to work for one’s own business.

For example, if a competitor is outsourcing a particular process, it is a good idea to consider whether one can also outsource it to the same party in order to be on equal footing with the competitor. At times, it may be the other way round. One may look at a competitor who is finding it difficult due to high dependency on external parties and decide to keep the processes within the business.

5. Taxation

Tax planning is very important for businesses, in order to achieve its financial and business goals. A small business owner has to take time out to familiarise himself/herself with the rules, analyse the implications of the business and choose investments and other options to save on tax. In this tedious process, taking a leaf out of a competitor’s book can be very useful. One can adopt the tax saving practices used by competitors and also get ideas on offbeat ways of doing so.

6. Financial records

Accounting is an art, and there are different ways of keeping track of the transactions that happen. There are also many software packages for recording and presenting data pertaining to the numerous internal and external transactions. Book-keeping can also be a tedious and resource consuming process due to the volume, complexity and varied nature of transactions. It is even more difficult to pull out data for a particular purpose or conduct an analysis. There is no point of making records if they can’t be used when required.

To get an idea of how to transcend these challenges and make recording transactions, categorising and analysing them an easier process, a business can take a look at what its competitors are doing. It is highly probable that other firms in the same industry would have done similar research and decided on a particular method and/or software for keeping track of the finances of their business. Turning to competition for insights on this aspect of finance can prove to be quite useful.

7. Funding

A competitor can obtain funding from a bank or an NBFC for meeting its short-term needs or for some long-term purpose. By knowing and enquiring about the debt details of your competitors, you can figure out whether or not the same lender can extend a helping hand to your own business.

A lending institution might be looking to grow its client base and therefore might be interested in adding you to its portfolio since you’ll be giving them business if you borrow from them. It is important to know the documents required, the purpose of the facility extended, payment terms and other contractual terms and conditions.

Since competing firms will face similar issues, investing time and resources in learning their strategies is a worthwhile pursuit. Finance, being a key aspect of any business, is a focus area for which valuable lessons can be learnt from competitors.

Are you looking for funding in order to grow your business? Get in touch with Gromor today!